The Day I Realized Dates Mattered More Than Paychecks

I always thought starting a new job meant immediate benefits, especially when the offer letter bragged about that killer health insurance package. Boy, was I wrong. This whole mess started about six months ago. I jumped ship from a decent but stagnant company to this flashy new startup. Everything felt great, signing bonuses, better title, the whole nine yards.

But then life hit hard. Not even three weeks into the new gig, my wife had a sudden, emergency trip to the hospital. Nothing critical in the long run, thankfully, but the bills piled up fast. I was sitting there, dialing the hospital billing office, feeling smug because I had those shiny new insurance cards in my wallet.

They asked for the insurance information. I gave them the plan number. They punched it in. Then the bomb dropped. The woman on the phone said, politely, “Sir, your plan shows pending status. Your actual qualification date hasn’t kicked in yet.”

What? I had started working! I had already gotten my first direct deposit! I argued, I pleaded, I demanded to speak to a supervisor. It didn’t matter. According to their system, I was in a blackout zone. I was fully employed but completely uninsured by the company plan. I had to pay a huge chunk of change just to get her out of the hospital.

The Deep Dive: Hunting Down the Eligibility Trap

That immediate financial pain lit a fire under me. I was furious. I went straight to HR the next day, practically marching into the office. I didn’t ask nicely; I demanded the rulebook. I needed to know exactly how I missed this crucial date.

I spent the next two days tearing apart every single document I had signed. That digital benefits guide? I printed it out, highlighted the whole thing, and circled every phrase that even vaguely referenced “eligibility,” “waiting period,” or “enrollment window.”

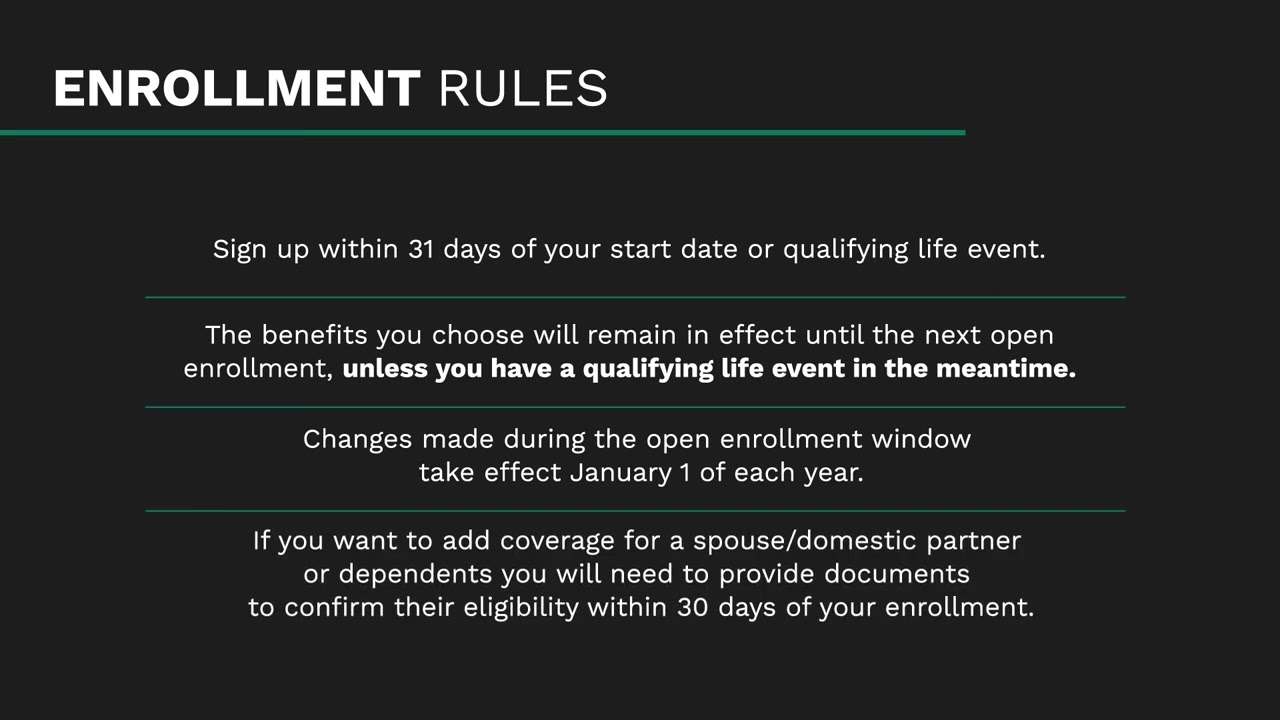

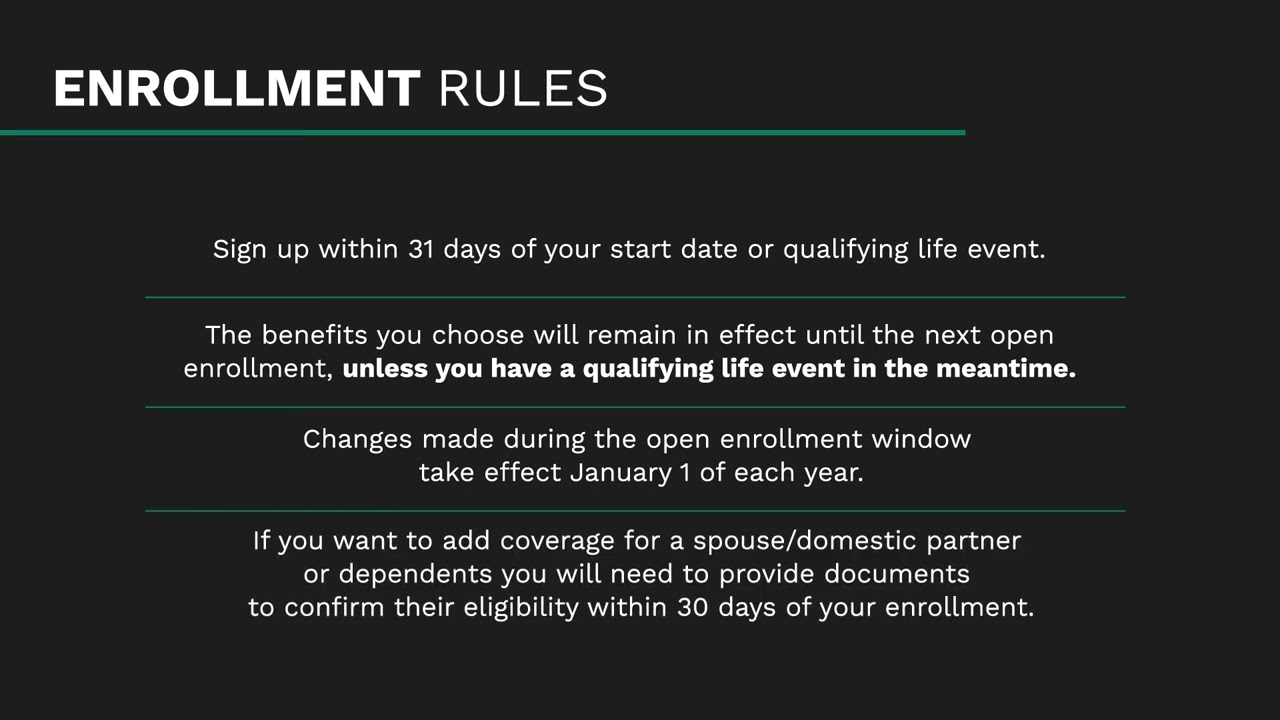

What I found wasn’t simple. It wasn’t one rule; it was a complex series of different rules depending on the benefit. It felt like they intentionally wrote it to confuse the hell out of you.

I started tracking my findings, comparing the date I started working (the Employment Start Date) versus the date the benefit actually kicked in (the Qualification Date):

- Medical Insurance (The Big One): This was the worst offender. The rule, buried deep on page 17, stated that coverage begins on the 1st day of the month following 60 days of continuous employment. Since I started on the 10th of the month, that 60-day window pushed me past the next 1st, delaying my coverage for nearly 80 days total.

- 401k Matching: They let me contribute immediately, which felt nice, but the company match? That only began on the one-year anniversary of employment. A full 365 days before they added a single dollar.

- Dental/Vision: Strangely, these were more straightforward. They had a flat 30-day waiting period, regardless of the start date. But I still missed the mark because the hospital visit happened on Day 18.

Confronting HR and Learning the Hard Rules

I finally got a sit-down with the benefits specialist. I showed her my chart, my circles, and my angry notes. She tried to give me the standard HR spiel, but I pushed back. I wanted a clear answer: Does the qualification date affect benefits?

She finally cracked and admitted the truth: “Yes, it affects everything. We use the date to manage risk.” She explained that just because I received the benefits packet didn’t mean I was qualified to use the services yet. The qualification date is the trigger point, and often, it’s set specifically to avoid covering immediate, costly claims for new hires who might leave soon.

It sounds cold, but it’s the reality I had to face. My work start date was meaningless for benefits purposes. It’s the specific qualification date listed for each individual benefit that matters.

The Takeaway: Never Trust the Start Date

I lost a lot of sleep and a big chunk of my savings fighting that initial bill. Now, I handle things differently. This whole episode taught me that you have to be extremely proactive. You can’t just assume the paperwork means coverage is live.

If you’re jumping jobs, here’s what I learned you absolutely must lock down before you shake hands:

- Force Clarity on Major Medical: Get the exact date your main health insurance goes into effect, written down, and signed by HR. Don’t accept “within the first 60 days.” Get the day, month, and year.

- Check the Benefit Bridge: If there is a gap between your old coverage ending and your new coverage beginning, you must get bridge coverage, maybe through COBRA from the old job, or a short-term private policy. That cost is way cheaper than one emergency room visit.

- Know the Investment Clock: Don’t just look at when you can contribute to the 401k, find out when the company starts matching those funds. That’s free money you might be missing out on for months.

I got burned because I was too excited about the new job and didn’t read the fine print close enough, especially those dates. Don’t make my mistake. The qualification date is the difference between a minor inconvenience and a massive financial headache.